The cost of motoring continues to rise as the Confused.com car insurance price index Q1 2017 reveals a year-on-year price increase of 18% –

Car insurance prices are revving up, with drivers in South West England paying £95 more for their premiums than they did a year ago.

According to the latest Confused.com car insurance price index, powered by Willis Towers Watson, South West England motorists are now paying £615 for the average comprehensive premium.

This is 18% higher than the amount they were forking out last year.

It seems that car insurance prices are on the up for drivers across the UK, with the average premium now rising 16% year-on-year to £781.

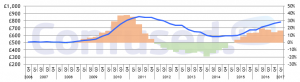

UK motorists have also seen a 2% (£14) increase since the last quarter. There’s further bad news for motorists, as the data from the Q1 2017 price index suggests the amount drivers pay for their car insurance is on its way to peaking.

Motorists are now paying just £77 less than the highest ever average premium of £858 which was seen in Q2 2011, with prices set to surpass this figure by the end of the year.

Car insurance costs could shift up a gear and pass the £1,000 mark in 2018 due to extra pressures imposed on the insurance industry.

This includes the Ogden rate cut which will see insurers paying out more for personal injury claims, as well as an increase to 12% for Insurance Premium Tax (IPT) in June.

This is coupled with hikes in road tax for new cars and petrol prices rising 4.6p to 119.7p/l since the start of 2017, it’s likely that many drivers will feel the cost of motoring burning a sizeable hole in their pockets.

However, it appears the latest car insurance price increases are draining the bank balances of some motorists more than others.

Looking at how cost rises vary between male and female drivers, both genders have seen their premiums accelerate over the past year, with men paying £119 (17%) more while women are paying £99 (16%) more.

There continues to be a worrying disparity between how much men and women pay for their premiums, with men spending £824 on average.

This is £96 more than female drivers, who pay £728 for their car insurance on average, despite the EU gender directive, which states that gender cannot be taken into account when calculating car insurance prices.

And when considering certain age brackets, the variation between how much male and female drivers pay for car insurance is staggering. For motorists aged between 17 and 20, there is a whopping £617 difference, with male drivers in this age group paying £2,363 for their premiums compared to a – still hefty – £1,746 paid by their female counterparts.

The gender disparity can be seen among more mature drivers, too. Even though 61 to 65-year-old women are paying the least for their premiums (£362) of any age bracket, men aged 61 to 70 are now paying more than they’ve ever paid.

Car insurance prices have peaked for this demographic, with male drivers aged between 61 and 65 now paying £518 after a 20% annual increase while those aged between 66 and 70 now pay £487 following a year-on-year rise of 16%.

Have you noticed any increases in your insurance policies recently?